Financial Debt, Workforce Reduction, and Crime: A Growing Crisis

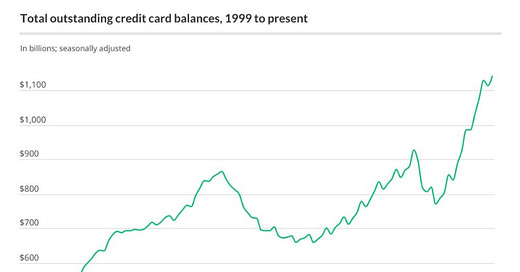

As credit card debt climbs and private-sector employment stagnates, Americans are facing unprecedented economic pressure.

The last jobs report prior to the election is out and it is not good news.

In 2024, the U.S. economy is witnessing troubling trends in consumer debt, workforce reduction, and an alarming correlation between these financial stressors and crime rates. Credit card debt has reached an unprecedented $1.142 trillion in the second quarter of 2024, while employm…

Keep reading with a 7-day free trial

Subscribe to Crime and Society Newsletter to keep reading this post and get 7 days of free access to the full post archives.